On 12 May 2016, Prime Minister David Cameron hosted a ‘landmark’ international anti-corruption summit in London at which invited countries made pledges about future anti-corruption efforts. Nigeria made many such commitments, including eight on increasing the transparency of beneficial ownership (BO). Of these, perhaps the most publicised was its commitment to establishing a public central register of company beneficial ownership information.

Disclosure of significant control and beneficial ownership was subsequently included within Nigeria’s Companies and Allied Matters Act (Repeal and Re-enactment) Bill (CAMA). After a slow and tortuous journey through the legislative process, the Bill was finally passed by the Senate in April 2020. However, producing legislation to develop a register is just one of many hurdles that need to be overcome in Nigeria.

The first is a self-imposed one. The lead agency, Nigeria’s Corporate Affairs Commission, suggested it would have the necessary website up and running within three months. That would be a tough task at the best of times, but the Commission also faces the monumental task of automating what is still a largely manual record system containing basic information about company ownership – such as registration number, company name, address and date of registration- gathered in accordance with legislation passed in 2004. A second hurdle is a fact the existing records need updating to allow for the inclusion of information on the beneficial owners of each company. Moreover, each of these pieces of information – old and new- needs to be verified by the Corporate Affairs Commission, otherwise, the information is likely to be both inaccurate and unreliable.

It is not going to be an easy task to construct an open, searchable register that meets the tests of accuracy and reliability. That said, the Corporate Affairs Commission is committed to producing an open and transparent register of BO, with access to company data (including beneficial as well as legal ownership) available free of charge. To this end, they have been working with the Non-Governmental Organisation OpenOwnership, which has been providing technical advice on international data standards. Amongst other things, OpenOwnership has supported the Nigeria Extractive Industries Transparency Initiative (NEITI) that has been piloting since 2013 (alongside 11 other EITI implementing countries), its own register of beneficial ownership in the Nigerian oil and gas and mining sectors. This laudable effort, in fact, highlights some of the difficulties in producing an accurate, reliable, open, and workable register on beneficial ownership.

Following some initial problems, the BO register is now functional, organised by ‘Oil and Gas’ and ‘Solid Minerals’ respectively. Fields by company (for which data is available) include:

- Beneficial Owner

- Nationality

- Age (appears unpopulated)

- % Holding

- Shares (partially provided)

- Politically Exposed Person status or PEP (partially provided)

- Stock Exchange Link (appears unpopulated)

- Owners

After watching the short video instructions on the NEITI website, we set about undertaking a search. The first company on the list of entries for ‘Oil and Gas’ is Addax Petroleum Exploration (Nigeria) Limited. Selecting it shows ownership as Addax Petroleum Holdings Limited (1%) and Addax Petroleum Overseas Limited (99%), both of which are recorded under ‘nationality’ as British Virgin Island. Clicking on the first of these companies opens a pop-up box of ‘other interests’ that contains two entries: OML (Oil Mining Lease) 124 (1%) and OML126/137 (1%). In Nigeria, under the terms of the 1969 Petroleum Act (section 2. (1) (c)), a lease may be granted ‘to search for, win, work, carry away and dispose of petroleum’. Leases are for a maximum period of 20 years but can be renewed by the Minister of Petroleum Resources. Clicking on the second company, Addax Petroleum Overseas Limited opens the ‘other interests’ box which shows OML126/137 (99%). Clicking on the ‘owners’ field provides the same information (for both companies): Addax Petroleum Development Nigeria Limited has a percentage Holding of 1%; OML124 1% and OML126/137 1%.

Entering either OML124 or OML126/137 in the search box brings up the same ownership as above – Addax Petroleum Holdings Limited 1% and Addax Petroleum Overseas Limited 99%. This time, opening the ‘other interests’ box for the Holdings company returns OML126/137 (1%) and Addax Petroleum Development Nigeria Limited (1%). Clicking on the second Company Addax Petroleum Overseas Limited opens the ‘other interests’ pop up box that shows Addax Petroleum Exploration (Nigeria) Limited (99%).

We repeated the search by randomly choosing OML29. This time the information returned has been shown in tabular form below:

| Search line term

Searching….. |

Beneficial Owner

Produces…. |

% share holding

|

PEP |

| OML29 | Aiteo Energy Resources Ltd | 45% | |

| Aiteo Energy Resources Limited | Aiteo Eastern Exploration & Production Company Ltd | 84% | |

| OML29 | 45% | ||

| Aiteo Eastern Exploration & Production Company Ltd | Aiteo Energy Resources Limited | 84% | Y |

| Benedict Peters | 1% | Y | |

| Taleveras Energy Resources Limited | 5% | Y | |

| Tempo Energy Nigeria Limited | 10% | Y | |

| Benedict Peters | Aiteo Eastern Exploration & Production Company Ltd | 1% | |

| Taleveras Energy Resources Limited | Aiteo Eastern Exploration & Production Company Ltd | 5% | |

| Tempo Energy Nigeria Limited | Aiteo Eastern Exploration & Production Company Ltd | 10% |

What both of these searches appear to show is that there is a relationship between the companies (and in the second search with an individual identified as a PEP) but not the direction of that ownership. This is presumably reflective of errors in the search algorithm of the database, likewise with the identification of companies as PEPs. In sum, a search of the NEITI register reveals certain information on companies with interest, but not the details of the direction of the ownership. Unfortunately, this makes it impossible to identify which of the companies is the true beneficial owner.

NEITI is to be applauded for getting this far in obtaining and providing access to information about ownership in the extractives sector. However, NEITI remains reliant on the companies themselves providing accurate information as they presumably have neither the resources nor the mandate to authenticate its accuracy, with companies accepting liability and bearing the consequences of the law for any information found otherwise.

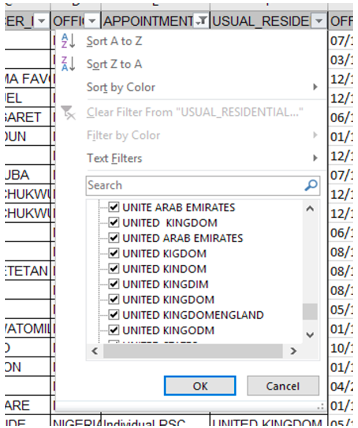

Nigeria needs to overcome such problems if it is to produce anything worthwhile. They are, of course, not the only country facing data accuracy problems. By this, we mean that those adding information to a database are at the same time also responsible for its accuracy. Further, there has been no requirement (nor indeed resource) for the registry to check entries prior to acceptance. The United Kingdom’s Companies House, for instance, faces a similar situation. They manage a database comprising some 8 million entries. A quick look at the Persons of Significant Control database from Companies House shows the problems with data entry into free text boxes where the data is not checked for accuracy prior to inclusion in the database. For example, the extract below reveals some interesting spelling mistakes that show the need for verification of data.

Giving Companies House an ability to verify information pro-actively would be an important development but will be reliant upon a change to legislation. The Government closed its consultation ‘Corporate transparency and register reform’ at the beginning of August last year and they are still analysing the feedback. Even if Companies House were granted such authority, there are significant (and costly) resource requirements to be considered. In short, searchable BO registers are to be warmly welcomed, but we should be under no illusions as to the challenges posed in making them reliable and functional.

Coming from the school of critical scholars, Jacqueline Helen Harvey‘s evidence-based work challenges existing frameworks and approaches. Her overall contribution to the discipline is around two main themes: anti-money laundering policy / asset recovery and the criminal interface with internal organisational structure. Harvey is a professor of Financial Management and Director of Business Research at Newcastle Business School, and is on the editorial board for the European Cross-Border Crime Colloquium that brings together researchers from across Europe. Harvey received her Ph.D. in Taxation Policy from the University of Bradford.